Western Australia’s powerhouse property market is continuing to grow. The continued steady increase in property prices means buying your own place isn’t just an exciting way to create your own home; it’s a lucrative investment in your future too.

WA and Perth property market overview

Western Australia’s stunning shoreline and enviable work/life balance are reflected in our house prices. The combination of a thriving mining sector and increased migration means demand is far outstripping supply. Which means Perth property prices are soaring.

Economic drivers affecting WA property growth

Various economic factors are driving WA property price growth. From positives like government incentives for first-home buyers increasing demand, to delays in the traditional construction industry slowing supply, there’s a perfect storm of drivers pushing prices up.

Home Guarantee Scheme

There’s a slew of incentives to help you embark on the journey to building or buying your own home. The Federal Government has expanded its Home Guarantee Scheme, allowing buyers to purchase their own home with only a 5% deposit, rather than lenders’ mortgage insurance.

The WA Government has also slashed stamp duty for homes in Western Australia, with the stamp duty threshold increased from $450,000 to $500,000 earlier this year (2025). Duty on vacant land has also been removed from land up to $350,000, with rates reduced for land between $350,000 – $450,000.

RBA Interest rate drop

For existing home owners or those beginning the process, the RBA’s 2025 interest rate drops are an encouraging sign.

The Reserve Bank cut interest rates three times in 2025, providing breathing space to existing mortgage holders and making owning your own home ever more possible for those looking to take that step.

These interest rate cuts make it a great time to invest in your own home, but they also tighten the market.

Population growth

Another factor driving up prices is population growth. Western Australia’s population has hit more than three million people for the first time, making us the fastest-growing Australian state in 2024.

Our population is expected to surpass 3.5 million people by 2036, according to a new report published by the Western Australian Planning Commission.

As shown in the chart, the WA population growth has been increasing since 2006, with no signs of slowing. It’s a pattern that affects the whole state. Increasingly, people are opting to migrate to regional areas to escape the pressures of capital cities. This means we’re seeing property market growth everywhere, not just in the Perth metro area.

Mining sector and infrastructure Investment influence on housing

It’s also hard to ignore the impact that a mining boom has on the housing market. While historically the fate of our property prices has been inextricably linked with the rise and fall of iron ore, Perth’s property market has remained buoyant despite challenges to commodity prices brought on by shifting global demands and the threat of tariffs.

Perth housing market predictions – Metro

House prices in Perth are only going one way, and that’s up. Perth’s property market is one of the nation’s top performers across both units and houses.

Perth Metro house prices

The median house price for the Perth metro area has continued to rise. While Perth is more affordable than other capital cities, such as Melbourne or Sydney, the median price for a house is now upwards of $800,000, although prices vary depending on the suburb and house size.

Perth metro unit prices

Price rises amongst units have been significant, with unit price performance expected to outstrip house price growth. The median price for a unit is $535,000, representing a 21% price increase over the past year. Despite the sharp rise, units are a more affordable option for those looking to invest in property.

Top Growth Suburbs and Emerging Hotspots

While prices are rising across the state, certain top-performing suburbs are experiencing higher levels of growth. North of the river, the top-selling metro suburbs are Perth, East Perth, Dianella and Maylands, while south of the river, Baldivis, Rockingham, Gosnells, and Armadale are doing well.

Perth housing market forecast – Regional

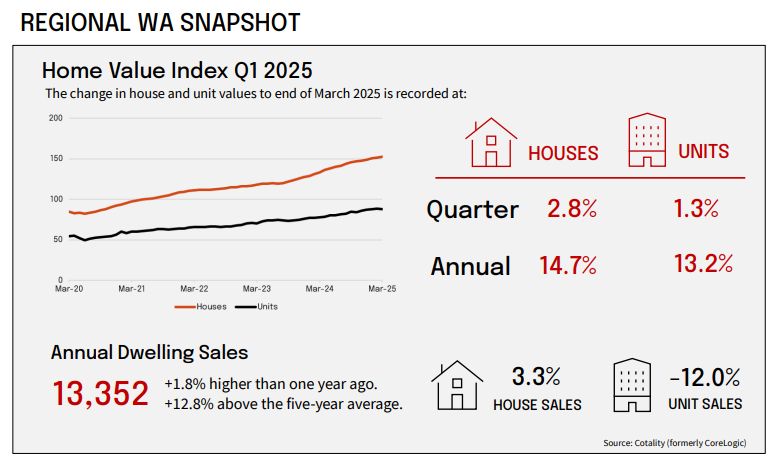

Regional house prices are also performing strongly, with prices rising and sales activity increasing, compared to last year. Regional WA outperformed Perth, with dwelling values rising +0.8% for the month, +2.7% over the quarter and +14.7% over the year, compared to Perth’s more modest increases of +0.2% monthly and quarterly and +11.9% annually.

While Perth’s house prices are substantially higher, the performance of property prices in regional WA, as represented by the chart below, shows that the demand and appeal are there for investment outside the capital.

Regional house prices – mining towns vs coastal areas

So, within the regions, where’s the better place to invest – towns linked to the mining boom or those by the coast? There are opportunities within both, as both have been performing well.

Coastal towns like Bunbury or Busselton have long-term appeal and prices remain high, because of the lifestyle they offer, as well as the economic diversity they offer.

Mining towns like Port Hedland or Karratha offer a more volatile trajectory. When there’s a mining boom, their growth can be explosive, but they can experience downturns if the minerals market crashes.

‘Based on current conditions, Albany, Busselton and Geraldton are likely to be the top performers this year, with median house sale price growth in the range of 15 to 20 per cent,’ said REIWA president, Suzanne Brown.

‘Bunbury and Karratha are looking to achieve around 10 per cent growth, while growth in Kalgoorlie and Broome is predicted to be between 2 and 5 per cent.

‘Growth is likely to be very low in Esperance, while the Port Hedland regional centre could see median house prices decline.

‘Every regional market is different, with different drivers,’ Ms Brown said.

People buy properties in mining towns vs coastal areas for different reasons. Investors like mining towns due to the rental market appeal, which offers high rental yields and low vacancy rates, while coastal towns appeal more to those looking for the holiday crowd or to create a beautiful second home.

Top growth in regional towns

Western Australian Premier Roger Cook wants to see the growth in regional towns expanding so that the most rapidly developing regional towns, like Bunbury, Port Hedland and Karratha, become major regional hubs.

The demand is certainly there. Regional towns like Bunbury and Geraldton all exceeded 5% quarterly growth at the beginning of the year. Geraldton’s median house price rose to $520,000 in the June 2025 quarter, making it the top-performing regional centre for the third quarter running.

REIWA regional spokesperson, Joe White, said: ‘There is a lot of infrastructure investment in and around Geraldton that is providing employment opportunities.’

If this pace of growth continues throughout the remaining two quarters of 2025, property in these areas would generate more than 20% annual capital growth.

Supply vs. buyer demand across the Perth metro and regional areas

Metro and Regional centres are likely to experience varied growth trajectories, depending on location and demand.

Perth metro outlook

The imbalance between supply and demand within the housing market looks set to continue in the metro area. Demand continues to increase, due to population and government incentives, but delays in construction mean supply continues to be tight.

Despite this, demand for houses and units continues to be high, leading to fast-selling times and price rises.

Regional market outlook

Southern centres, which appeal to holidaymakers while maintaining decent infrastructure, are expected to experience sustained growth, accompanied by significant price increases of between 10% and 15%, due to the lifestyle and employment opportunities they offer.

Other regional centres, like Kalgoorlie, Karratha and Port Hedland, might see smaller rises of around 5%, due to their reliance on mining.

Perth property market forecast and predictions

Forecasts for the Perth property market are optimistic, with experts across the sector agreeing that prices will continue to rise.

The diversification of Perth’s economy means the boom-and-bust cycle, linked to mining prices, no longer has such an acute impact on prices, making it a sound market to invest in.

12-Month Price Predictions in Perth and WA

Price rises for the next 12 months seem like a foregone conclusion, with forecasts predicting the city’s median house price will hit $1 million by the end of 2026.

As part of this upward trend, REIWA reports that house prices are currently expected to grow by 10% in 2025.

While frenzied buyer behaviour has disappeared, properties are still moving quickly, with prices varying from suburb to suburb.

Interest rate impact scenarios on market growth

The long-awaited interest rate cuts we’ve seen so far in 2025 are easing some of the pressure on homeowners and stimulating the sales market.

Perth’s outer suburbs, including areas such as Mandurah, Midland-Guildford, and Balga-Mirrabooka, have benefited the most from the interest rate cuts, with price rises of over 15%.

Should the RBA opt to cut rates again in November 2025 or early in 2026, we could see another surge in property prices across the board.

The demand for housing

Demand for housing is prompting people to think creatively when it comes to buying or building a home. Alongside traditional homes like townhouses, villas, units and detached houses, there’s a rise in tiny homes, granny flats, and modular and prefabricated homes.

The advantages of less traditional homes like modular or prefabricated is that they are much quicker to build. Constructing in a factory off-site means that your home isn’t subject to weather delays or groundworks.

Multiple pieces of the house can be worked on at once, meaning its construction is swifter and more affordable.

Modular homes can also be more sustainable, increasing their popularity.

What are industry experts saying?

Industry experts agree, pointing out that Perth’s property sales market is the tightest it’s been in a decade. This, combined with cheaper interest rates and a rising population, means that Perth’s property market is likely to be undersupplied for at least the next three years, with double-digit price hikes for the next 12 months, according to former REIWA president and Chairman of Westbridge Funds, Damian Collins.

‘Most locations in Western Australia are suffering from an acute shortage of residential properties, and we can’t build enough new homes to keep up with demand. This is forcing prices of established homes to rise as demand outstrips supply.

If we want to provide enough homes, alternative construction methods need to be explored. It’s been demonstrated that what we are doing now is not going to solve the housing crisis, while our population continues to grow.’

Domain’s chief of research and economics, Nicola Powell, also warned that the price rises could make it difficult for people to enter the traditional housing market.

‘If you’re trying to break into the property market, the next year could be your toughest challenge yet,’ she warned.

Moving forward in the face of the housing crisis

The housing boom shows no sign of coming to an end.

While this is good news for existing homeowners, who benefit from increasing prices and decreasing interest rates, it does little to address the issue of reduced supply for those looking to buy their own home.

Construction delays, coupled with a shortage of existing property on the market, mean that alternative housing could hold the solution.

With affordable prices, significantly shorter building times of around 12 weeks, and increasingly sophisticated designs, a modular build could be the best way to create the home you’re looking for.